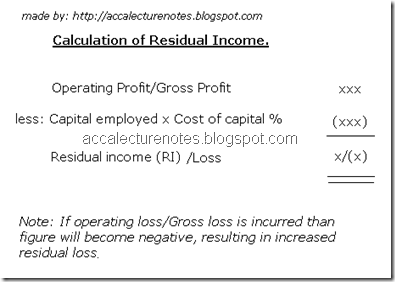

Residual income is another for performance measurement tool. Residual income can be determined by deducting the notional cost of investment from the operating profit.(PBIT). Notional cost of investment is obtained by multiplying capital employed (Total Asset - Current Liabilities) with cost of capital expressed by term of percentage. The cost of capital can be any rate or percentage. It may reflect cost of obtaining the investments in term of interests, ordinary & preference dividend payable or % of income derived if the capital is used elsewhere in the business.

There are many profit figure available that can be used for the calculation of RI. Operating profit or PBIT can be useful when division under consideration has control over its operating costs, where as gross profit can be used when division no control over operating cost. In later case, all the major administration, selling & distribution decisions are taken by head office on a centralized basis.

Cost of capital is calculated the same as ROI which is the Net Asset + Long Term Liability or Total Asset - Current Liability both gives the same result. You can use any of them according to data available.

Advantages of RI is that it is an absolute measure. It takes into account of Profitability in money terms. This is particularly useful for profit motive organization which seeks increase wealth. RI can be easily calculated using data extracted from financial statement and understandable to non-financial managers as well. It encourages goal congruence (business objective = divisional objective) if it is linked with reward schemes. Dysfunctional behavior indentified in the use of ROI which resulting in rejection of the investment acceptable to the business by the divisional managers. Different cost of capital can be used for each division to reflect the level of risk undertaken by division to reach certain profit level. In this way divisional managers can be discouraged to take risky investment and operational decision that are beyond acceptable limits identified by the business.

Limitation of RI is that it take no account of relative profitability or size of each division. It means if Division A has achieve profit of $10,000 using $1,000,000 of capital it will look better than Division B which has achieved profit of $8,000 using $5,000,000 of capital. There is an element of subjectivity regarding the choice of cost of capital using different cost of capital for different division may be difficult to justify.

No comments:

Post a Comment

Please! Provider your comments. Your comments are most valuable asset for me.

If want to provide appreciation, then please copy & paste the following website address http://accasupport.com/ to refer on your social networking account, website, blog, forum etc,

http://accasupport.com is my parent website connecting my all blog & provides free ebooks on make money online and ACCA exam papers.