Return on investment or capital employed(both as same) is the most widely used divisional performance measure. One reasons of this may be, figures needed to calculate can be easily extracted from published financial statements, so there is little need of time and resource to calculate it.

ROI gives an indication of resource utilization capability of the business or division. How intensely business has utilized its Assets to generate income.

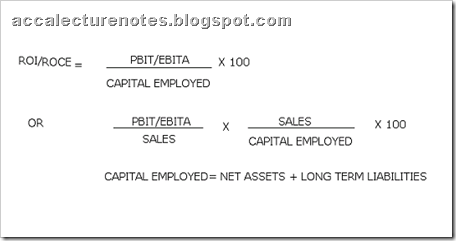

It can be calculated in various ways, there is no universally accepted formula for this measure. Each company has adopted its own version of return on investment as a performance measure. You would have to look for organizational policies regarding this measure.

Most commonly used profit figure is PBIT (Profit before interest and tax). This is because, generally, divisional managers have no control over financing decisions and tax figure can be changed through careful tax planning, so it has weak correlation with divisional performance.

Another profit figure can be used is EBITDA (Earnings before interest, tax, depreciation and amortization). This is because divisional managers also have little control over investment decisions. This gives more accurate reflection of divisional performance as it eliminates non-cash expenses, not incurred as a result of divisional performance.

Return on investment can be Net Assets (Total Assets - Total Liabilities) + Long term liabilities or Total Assets - Current liabilities. Taking shareholders funds as well as Debt finance gives the overall investment figure. Especially if the divisions raising their finance separately, as borrowings will also affect divisions profitability. Alternatively, business may choose to evaluate divisional performance on net asset basis. However, its is the matter of organizational policy.

Advantages of ROI is that is takes account of relative size of different divisions. So it can be used to compare inter-divisional as well as performance in relation to external business having similar characteristics. It is easy to calculate and understand by divisional managers.

Limitations of ROI is that it is a relative figure it can mislead organization in term of percentages by not considering actual profit figure. Ex. Division A with 40% ROI and $20,000 of divisional income might be preferred in resource allocation over Division B with 20% ROI and $30,000 of divisional income, ignoring the fact Division B is contributing more towards recovery of fixed cost, like interest expense, Similarly other strategic decisions would be taken wrongly, Like Cross-selling benefits.

It may lead to dysfunctional decision making if managers are rewarded on the basis of ROI. Managers are likely to accept proposal which increases their divisions ROI which can be detrimental to the companies reputation and future prospects. Conversely, Proposals which decreases their ROI than current level are rejected as it will decrease the overall ROI of their division, no matter how effectively it will contribute towards achievements of business objectives in the long-term.

Thanks for a wonderful share. Your article has proved your hard work and experience you have got in this field. Brilliant .i love it reading. film finance companies

ReplyDelete